20. March 2024 By Philipp Mader

The „Framework for Financial Data Access“ (FIDA)

Opportunities and challenges for the insurance industry

When the cult film "Back to the Future" hit cinemas in the mid-1980s, it painted a fascinating picture of the future: in 2015, flying cars, up-to-the-second weather forecasts and hoverboards would be part of a futuristic society.

Almost a decade later, it is clear that these visions have largely remained dreams. However, it is not only in the areas of mobility and meteorology that real developments are lagging behind the cinematic prophecies; the digitalisation of various areas of life has also not yet reached the level that many had hoped for.

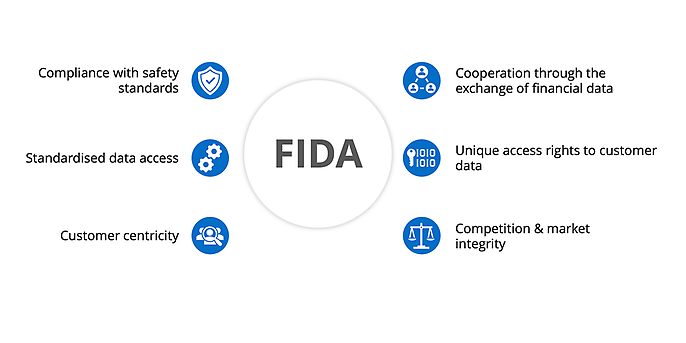

Despite this discrepancy between fiction and reality, digitalisation is progressing in all areas of life and is opening up new opportunities and challenges for both consumers and companies. A particularly striking example of this is the "Framework for Financial Data Access" (FIDA), the framework proposed by the EU Commission to simplify access to and use of financial data. FIDA sets new standards for data protection and transparency and has the potential to accelerate the transformation of the European insurance industry in the long term.

Open Insurance - a concept becomes reality

As part of the overarching concepts of Open Finance and Open Data, Open Insurance focuses on customer centricity, openness and standardisation in order to promote innovation and better services in the insurance sector. Similar to Open Banking under PSD2, which regulates the exchange of data between banks and third parties, Open Insurance aims to facilitate the exchange of insurance data. Open Insurance allows users to retain control over their data and share it with third-party providers. The aim is to create new insurance products and services tailored to the needs of customers and increase efficiency and transparency in the industry. However, open insurance is still in the early stages of development. Although there are initial approaches in institutional data transfer between insurers and their partners (Digital Pensions Overview ), a customer-centred data exchange, comparable to open banking, and a corresponding regulatory framework are still lacking. The aim of Open Insurance is to create such a framework that promotes innovation and the creation of new business models by relying on standardised communication via APIs (Application Programming Interfaces) and process standards.

The role of FIDA - driver for open insurance?

As part of the digital transformation of the financial sector, the European Commission's proposed regulation "Framework for Financial Data Access" plays a key role in the development and implementation of open insurance. FIDA aims to create a standardised legal framework that enables the secure and efficient access and use of financial data across industry boundaries. For the insurance industry, this represents an important step towards a more open, standardised and customer-oriented exchange of data.

The introduction of FIDA could accelerate the development of new, data-based insurance products. Insurers now have the opportunity to assess risks more accurately and create customised offers that meet the individual needs and life situations of their customers. In addition, insurance products can be seamlessly integrated into broader financial services, resulting in a more comprehensive and customer-centred service. The creation of a harmonised legal framework is intended to promote innovation in the EU in a targeted manner. This harmonised framework should ensure that all market participants - from established banks and insurance companies to start-ups and FinTechs - have the same opportunities to access financial data.

Figure 1: Objectives of the FIDA Regulation

Rights and obligations for insurers under FIDA

As part of the legislative process for the FIDA regulation in the EU, the regulation is expected to come into force from 2025, although the European elections in June 2024 could still lead to delays. The change is expected to be felt by end customers in the course of 2026.

The FIDA regulation could fundamentally change the rules of the game for insurance companies. It sets fixed standards for data provision, not only for data owners (i.e. insurers), but also for external third parties (data users). What was previously voluntary will become mandatory. Standardised data exchange across industry boundaries will thus become mandatory.

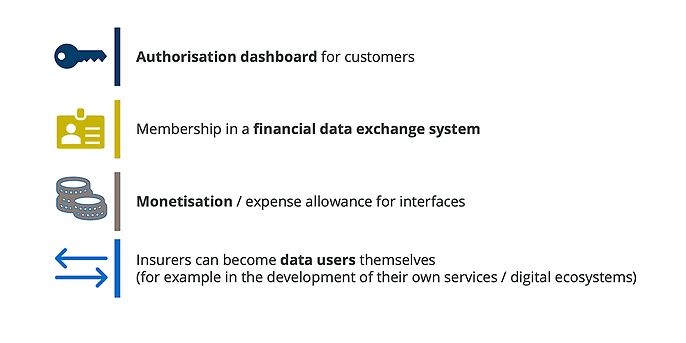

- Strengthening customer autonomy: Insurers must offer a dashboard that customers can use to monitor and manage their data access, similar to the PSD2 mechanisms in online banking.

- Cross-industry cooperation: Within 18 months of the regulation coming into force, membership of one or more financial data exchange systems will be mandatory to ensure data delivery according to defined standards.

- Monetisation opportunities: Insurance companies can charge an expense fee for API access, which can be a new source of revenue.

- Utilising dual roles: As data owners, insurers are not only data providers, but can also act as data users to create new, customer-centric added value, for example through pension cockpits on their own digital platforms.

These changes not only entail new obligations for insurers, particularly in the handling of financial data, but also open up opportunities for business model innovations - provided that strict data protection regulations are observed, data transparency is guaranteed and customers have control over their data.

Figure 2: Rights and obligations for insurers

FIDA as an opportunity for repositioning

When "Back to the Future" projected visionary technologies into the near future in the 1980s, the film sparked fantasies about a time in which digitalisation would permeate life to an extent that was previously unimaginable. Almost four decades later, reality may not be able to keep pace with all of the film's prophecies, but it is still characterised by advancing digitalisation, particularly in the financial sector.

The "Framework for Financial Data Access" (FIDA) marks a milestone in this development. It not only represents a repositioning in the handling of financial data, but also the opportunity to raise the insurance industry to a new level of transparency, data protection and customer focus.

FIDA is an invitation to the industry to break away from the reality of the present and take the leap into a future characterised by openness, innovation and customer-oriented services. The analogy with the cult film is particularly apt here: even if the leap into the future was symbolised by flying cars and hoverboards, these futuristic visions have largely remained utopias. Today, it is digitalisation and the innovative use of data that define progress.

In conclusion, FIDA is much more than a regulatory obligation. It is an opportunity for the insurance industry to evolve and keep pace with the digital transformation. Customer expectations are constantly rising.

FIDA offers the opportunity to create innovative and customer-centric insurance solutions: by integrating and analysing external data sources such as health data, real-time vehicle data or property information. This data enables customised insurance products that are precisely tailored to the individual needs and risk profiles of customers. Ecosystems based around smart homes, connected vehicles or wearables harbour enormous potential, as they not only enable risk-appropriate tariff models, but also offer preventive services and immediate claims settlement through direct access to data.

Such solutions not only meet the requirements of the present, but also build a bridge to a future that may not be as far away as depicted in "Back to the Future".

Would you like to find out more about exciting topics from the world of adesso? Then take a look at our previous blog posts.

Also interesting: