2. January 2024 By Simon Bächle

Energy industry in transition: prospects and trends for 2024

The energy industry is undergoing a number of changes and developments. These include the rollout of variable electricity rates as an incentive for customers, preparations being made to expedite the process of switching suppliers, measures to reduce electricity prices for industry and the expansion of renewables. At the same time, there is also a focus on legislative initiatives such as the planned German Act on the Digitisation of the Energy Transition (Gesetz zur Digitalisierung der Energiewende – GDEW), which sets 2030 as the target year and aims to speed up the rollout of smart meters. These developments, which are described in detail below, highlight the need to adapt to the current challenges in and targets for the electricity sector.

These three drivers have a significant impact on the energy industry

There are three key trends driving the energy sector: decarbonisation, decentralisation and digitalisation. These not only influence the way we generate energy, but also how we use and distribute it.

Decarbonisation

Climate change and its growing impact on humanity have made decarbonisation a central concern of German policymakers and hence the energy industry as well. The search for low-carbon and emission-free energy solutions has become a key factor driving efforts in this area. Renewable energy sources such as solar and wind power are growing in importance, while electromobility is also picking up steam at the same time.

Decentralisation

The electricity industry in Germany is undergoing a paradigm shift. In the past, energy was fed in centrally from large power stations and transported on demand to consumers across all levels of grid under the top-down principle. The expansion of renewables is shifting the system over towards decentralised generation, with 90 per cent of this power fed into the distribution grids.

Digitalisation

Digitalisation is making its way into all areas of life, and the energy sector is no different. Virtual power plants, smart grids/meters and IoT applications are revolutionising the way we generate, distribute and use energy. There is demand for a whole host of digital solutions, covering everything from high-precision monitoring and efficient management tools to solutions used to optimise energy processes. If the energy sector is not fully digitalised, it will not be possible to generate electricity from 100 per cent renewable energy sources.

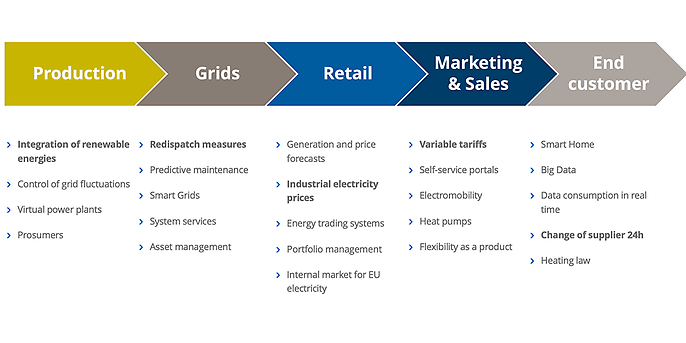

The effects are felt across the entire value chain

The value-added stages in the electricity industry include everything from power generation from an array of different sources, transmission and distribution to trading and sales, which ultimately entails supplying electricity to end consumers. The following diagram provides an overview of the disruptive trends in the individual stages of the value chain.

Disruptive trends along the value chain

Variable electricity rates for household customers

There is a new push in the constantly changing energy sector for electricity suppliers to expand the number of rates they offer customers. Section 41(a) of the Energy Industry Act (Energiewirtschaftsgesetz – EnWG) stipulates that electricity suppliers must offer end consumers rates that incentivise them to save energy or manage their energy consumption. But that is not all. There is also a focus on electricity rates that provide incentives to conserve energy or use it sparingly. Load-variable rates or rates based on the time of day are one of the prime focuses here. These should not only be technically feasible but also make economic sense. The aim here is to encourage consumers to be aware of their energy consumption while at the same time promoting energy efficiency. Before this can happen, however, end consumers need to have a smart meter. This is currently not yet always the case owing to delays in their rollout. The goal of dynamic rates is to make the inelastic demand for electricity from household customers more flexible by providing financial incentives.

Larger electricity suppliers that deliver power to more than 100,000 consumers are required by law to offer dynamic rates and provide related information by year’s end. The regulation will apply to all electricity suppliers from 1 January 2025.

Preparations for providing customers with an option to switch suppliers within 24 hours

By no later than 1 January 2026, the German Federal Network Agency (BNetzA) mandates that there must be a technical process in place that makes it possible to switch electricity suppliers on business days within 24 hours. At the moment, this may take upwards of three weeks. (The draft bill is currently in the consultation phase.) That said, however, this requirement means that extensive changes must be made to the IT systems of suppliers, metering point operators and distribution system operators. In addition, there will be far-reaching changes to business processes for supplying customers with electricity (GPKE) and with regards to change of suppliers in metering (WiM), which must be made by the relevant stakeholders. It is therefore recommended that companies take steps early on to prepare the necessary systems and processes to meet this requirement.

Electricity prices for industry

The price of electricity in Germany is increasingly a problem for industry, especially for energy-intensive manufacturing sites. Production costs are driven up sharply by energy costs, and there is a risk that products can no longer be sold on the global market at competitive prices.

The German government has presented a series of plans to reduce the burden on industry. The reduction in electricity prices includes a subsidy on grid fees and a lowering of the electricity tax for all manufacturers to the EU-wide minimum rate of 0.05 cents per kilowatt hour; currently, the electricity tax for companies is 1.537 cents per kilowatt hour. This would benefit large electricity-intensive companies and SMEs as well.

In addition, the electricity price compensation mechanism is to be extended and the current own contribution of around €70,000 per production plant is to be abolished. This affects around 350 companies for which policymakers are attempting to reduce the costs of EU emissions trading through such schemes. The cost of the subsidies will be partially financed out of the German budget and by way of the Climate and Transformation Fund.

Bottleneck management and expansion targets for photovoltaics and wind power

Ambitious targets for the expansion of renewables have been set in order to achieve the climate targets. Nine gigawatts (GW) of photovoltaic and 3.9 GW of wind capacity are to be added by 2023. From 2026, 22 GW of solar and 7.8 GW of offshore and onshore wind capacity are to be installed annually. The good news is that the target in the solar sector for 2023 has already been exceeded thanks to 12 GW of newly installed capacity. At only 2.6 GW of added capacity, the expansion of wind energy is still well below target.

| Goal 2023 | Added capacity as of 19.11.2023 | |

| Photovoltaic | 9 GW | 12 GW |

| Wind | 2.6 GW | 2.6 GW |

This rapid expansion of renewables across Germany means that grid operators have to speed up the expansion of the grid. Grid expansion is currently lagging behind, meaning that on sunny and windy days, grid operators are often in a situation where the amount of power fed into the grid leads to overloads. To prevent grid bottlenecks, grid operators use various techniques to manage this issue. One of them includes the redispatch method, which helps avoid line sections in the electricity grid overloading by regulating the feed-in power of power plants. It often happens that too much wind power is generated in northern Germany, which causes a bottleneck in the transmission lines to southern Germany. To overcome the grid bottleneck, the feed-in capacity of wind turbines in the north is being scaled down, while at the same time other power plants in southern Germany are being ramped up. The power plant operators affected by redispatching are then compensated for this service.

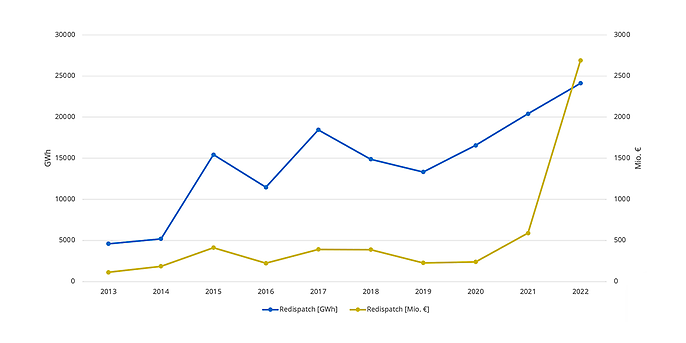

Bottleneck management is a highly complex undertaking. In addition, redispatch volumes and costs have been rising sharply for years (see figure below), and these added costs are ultimately passed on to customers. The grids must also be scaled up to handle the integration of ever-larger amounts of renewable energy in the future. If not, redispatch costs will likely continue to rise.

Development of redispatch volumes and costs , Source: BDEW 2023

Act to Reboot the Digitalisation of the Energy Transition (Gesetz zum Neustart der Digitalisierung der Energiewende – GNDEW)

The Act on the Digitisation of the Energy Transition 2030 initiated by the Federal Ministry for Economic Affairs and Climate Action (BMWK) has the clear objective of speeding up the rollout of smart meters in order to facilitate dynamic electricity rates. All stakeholders should benefit from a reduction in bureaucracy in administrative procedures and an increase in legal and planning certainty.

The act mandates the installation of smart meters at consumption points with an annual consumption of more than 6,000 kWh and for electricity generation systems (for example, photovoltaic installations). It sets upper limits on charges based on annual consumption in order to protect consumers from excessive costs. For most customers, the cost of a smart meter will be the same as it is for a digital electricity meter at around €20 per year.

If you would be interested in discussing trends in the energy industry with us,

we will be on hand at E-World energy & water as we are every year to showcase our innovative solutions for the digitalisation of the energy industry. Our experts use the platform to discuss the latest developments in the European energy sector with our customers.

Interested? We look forward to meeting you in person at the 2024 E-World (booth C127/hall 1). You are welcome to make an appointment in advance.

Learn more and an set up an appointment

Would you like to find out more about exciting topics from the world of adesso? Then take a look at our previous blog posts.