26. October 2023 By Sandra Weis

The contribution assessment ceiling is set to be raised significantly in 2024 – this also has implications for company pension schemes

Employees have the right to request that their employer pay part of their future earnings into their company pension scheme through via deferred compensation. The draft version of the 2024 Social Security Computation Regulation (Sozialversicherungs-Rechengrößenverordnung 2024) provides for a significant increase of the income threshold for the year 2024. But what implications does this have for company pension schemes? What are the associated challenges to companies, employees, insurance companies and pension providers? And how can they be overcome? You can find answers to these questions in my blog post.

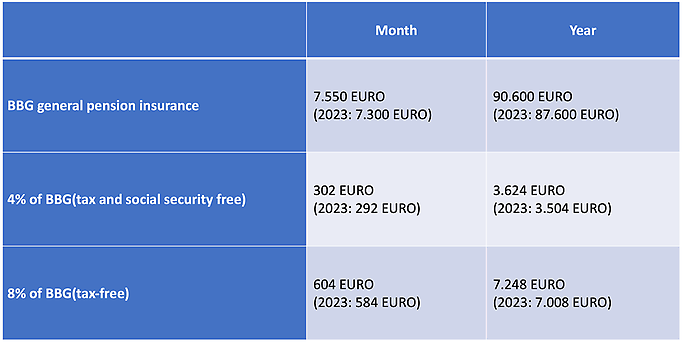

Section 1a of the German Act on the Improvement of Occupational Pensions (Betriebsrentengesetz, BetrAVG) governs the right to a company pension via deferred compensation. This clause stipulates that employees have the right to request that their employer defer up to four per cent of the relevant contribution assessment ceiling established in the general pension insurance system (Contribution Assessment Ceiling West (BBG West)) from future earnings and pay this into their company pension plan. This step is designed to protect workers from old-age poverty. Up to now, the maximum taxable contribution for company pensions could be raised or lowered via an annual adjustment of the contribution assessment ceiling.

On 11 September 2023, the Federal Ministry of Labour and Social Affairs published the draft version of the 2024 Social Insurance Calculation Regulation, which proposes that the income threshold be raised significantly. The bill is expected to be ratified by the German cabinet in October without any significant changes. This will then be subject to the approval of the Bundesrat, which is considered a mere formality owing to the statistically calculated income trend for the previous year. It is worth pointing out that the increase in the income threshold will also have an impact on company pension schemes.

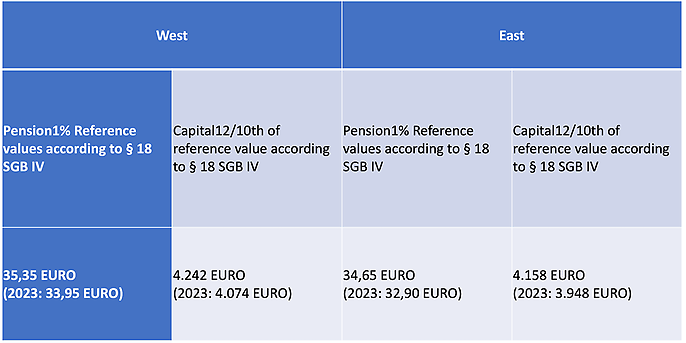

Expected calculation basis for 2024 for company pension schemes

Pursuant to Article 3(2) of the German Act on the Improvement of Occupational Pensions (Betriebsrentengesetz, BetrAVG), vested entitlements may be paid by the employer without the consent of the employee if they do not exceed a defined de minimis limit. Corresponding adjustments are also expected for 2024.

Effects of the adjustment of the contribution assessment ceiling on company pension schemes

Let us assume that an employee agrees with the employer that part of their future earnings – four per cent of the relevant contribution assessment ceiling – will take the form of deferred compensation. This means, for example, that they set aside part of their gross salary each month, which will be paid into a pension fund policy funded by the company. When the German Act on the Improvement of Occupational Pensions entered into force in 2018, employers were obliged to subsidise the pension plan of their employees under certain conditions by providing a subsidy for deferred compensation. As originally conceived, employers were only required to pay this contribution for all new deferred compensation policies dated 1 January 2019 or later. However, since 1 January 2022, existing deferred compensation agreements also are subject to this obligation. This contribution paid by the employer amounts to a flat rate of 15 per cent of the deferred compensation, provided that the company actually saves social security contributions.

Implications for employers

When the income assessment ceiling is raised, this will change the contribution for deferred compensation (such as for a pension fund policy) and may also affect the subsidy paid by the employer. The company that employs the employees is required to take the adjusted amount of deferred compensation into account in payroll accounting. Along with this, the statutory compulsory subsidy is also adjusted accordingly. The new total contribution will need to be transferred to the insurance company or the pension provider – in this case, to the pension fund.

Implications for employees

The benefits provided by the insurance company or pension provider resulting from the deferred compensation increases, and the pension gap for the employee decreases. This information will be provided in the applicable documents, for example, in the addendum to the insurance policy.

Implications for insurance companies and pension providers

In many cases, one of the main challenges is that there is either inadequate technical support for portfolio management systems or none at all. This applies in particular to products with variable premium payments, where the contributions paid by employers are taken into account as an integral part of the insurance policy. Employers may make contributions that exceed the maximum amount free from social security contributions. In such cases, it is difficult for the insurance company to determine how to deal with the situations like this.

Information and communication needs

Increasing the contribution assessment ceiling often increases the need for information and communication. This must be geared towards the requirements of the target groups achieved through the selective processing of information, requiring the use of different communication channels.

Solution

The use and processing of the information should be done in a way to keep costs low. It is essential to choose a technical solution that can also be used for future increases in the contribution assessment ceiling, meaning that appropriate measures must be developed, which could include:

- Obtaining professional support

- Improving technical support

- Using a variety of different communication channels

- Preparing documentation such as informational material

Experts with practical experience and in-depth business expertise should verify the effects as well as define and, if necessary, implement appropriate measures based on this information. They should be familiar with the topic of company pension schemes and also have technological skills in order to assist in making the necessary changes to the IT systems, if necessary.

Would you like to learn more about exciting topics from the adesso world? Then take a look at our blog posts that have appeared so far.

Also interesting: